Zhuravel V.G., PhD Shevtsova E.I., Goncharova Y.S.

Oles Honchar Dnipropetrovsk National University, Ukraine

CAPITALIZATION OF BANKING SYSTEM OF UKRAINE: ANALYSIS AND PROSPECTS OF DEVELOPMENT

Today involvement and support of capital in sufficient volume is a basic requirement in the national banking system. It determines the topicality of this issue as the international aspect of the high level of capitalization of the banking system and is a sign of stability.

The purpose of research is to analyze the dynamics of growth of the equity of the banking system in Ukraine and suggest ways of increasing the capitalization of Ukrainian banks.

The National Bank of Ukraine sets the regulatory capital adequacy ratio, which value in the existing banks should be not less than 8% and from 3/1/2004 – not less than 10% [1].

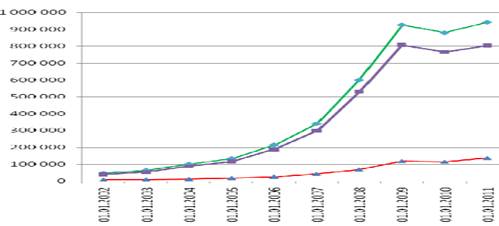

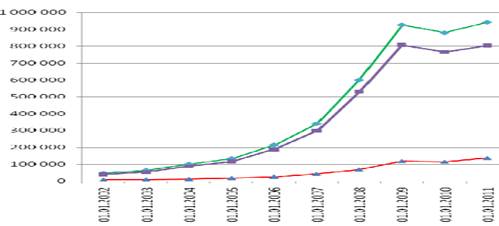

If we look at the dynamics of indicators in nominal terms, we will see that the annual growth in total assets of Ukrainian banks from 2002 to 2009 was in average 53.1%, the increase of banks' equity capital was 48.35%. In 2010 growth of total assets was 1.71%, growth of equity capital – 0.42%. We cannot agree with the assertion of some economists that the capitalization of the domestic banking system is adequate to conditions of our economy [2].

In the environment where the capital growth significantly lags from the growth of assets, the problem of banks capitalization is particularly important. If this pattern continues to exist, the problem of adequacy of bank capital and the threat of violation of stability and efficiency of the banking system also take place. Growth of this indicator to 18.28% for the period of 2009 can be regarded as a positive trend because its growth has been driven by falling growth of total assets and net assets of the Ukrainian banks [2].

As a result, in the near future, the banking system can get into the "trap" of rapid growth – a lack of capitalization will begin to restrict lending. About 70% of commercial banks revenues are loan activity; the reduction of poverty in these circumstances is a direct threat to the stability of the banking system [3].

Of course, the Ukrainian banks still have some margin for such policies because critical index may be in 11% .

As reported, the NBU demanded 61 additional capitalizations of financial institutions with total amount about 40 billion hrivnia after making of stress testing of the Ukrainian banks in 2010. Solving this problem is making additional contributions or improving quality of asset by its owners.

Each bank must have own funds for its work, the bulk of which is the statutory fund. If the Bank's authorized capital is formed by the state budget, the authorized capital of commercial banks will be formed by contributions from shareholders or participants. In Ukraine the authorized capital of commercial banks amounted to 119,189 million on 01.12.2011, which is in 1.5 times more than in 2010.

Banking system should be evaluated and reformed along with the state reform of the entire economy and particularly the real sector. Banking system, further capitalization of Ukrainian banks reflects economic growth and improves the profitability of the banking business as economic activity.

Fig. 1. Growth of indicators of the banking system

(for the period from 01.01.2002 to 01.01.2011 years)

As reported in official data, 37 Ukrainian banks had the net loss in January-September 2011, or 21.14% of the existing financial institutions, while the first half brought a negative financial result of 33 banks (18.75%) and the first quarter – 32 (18.18%). According to experts' opinion, it is necessary to underline that from the beginning of the crisis it was first pointed out that not only the citizens of Ukraine have to pay taxes, but also the banks that work in this country. Therefore, banks have to show income. For several years, some banks are showing losses, including those that consistently work. So the situation is next: bankers were simply forced to share the money with the people. This means that it is too early to speak about stabilizing of the banking system because now the rate of capital is an indicator of stability of the banking system, not profit.

I agree with the opinion that in such conditions in which the Ukrainian banking system exists now, the best ways to increase capitalization of banks is to increase index of regulatory capital adequacy through the consolidation of our banking system (consortium lending, establishment of bank mergers, mergers of banks, their reorganization), and not only by the ways that were nominated by NBU last year. This would allow increasing the resilience and stability of the entire banking system. But such activity is impossible without the implementation of measures by the central bank and regulatory framework that would identify the procedure for consolidation of banks. Of course, except for the objective reasons that hinder the process of banks consolidation, there are subjective ones, – the reluctance of major shareholders to merge with other banks. Exit from this situation may be the establishment of bank mergers, such as financial and banking holding group or banking corporations. Thus they retain ownership, management, and apportionment of income. On the other hand, consolidation of the banking system will not affect the level of competition, because the interest of rate policy of commercial banks is almost entirely dependent on the NBU policies [2].

Literature:

1. Активи, забов’язання, капітал банків України [Електронний ресурс]. – Режим доступу: http://aub.org.ua/index.php?option=com_grafik&menu=104&Itemid=102.

2. Квасницька Р.С. До питання капіталізації вітчизняних банків [Електронний ресурс]/ Р.С.Квасницька, Г.Г. Старостенко. – Режим доступу: http://www.nbuv.gov.ua/e-journals/znpnudps/2009_2/pdf/09krstcb.pdf

3. Белінська Я. Стабільність банківської системи: загрози та шляхи їх подолання. [Електронний ресурс] / Я.Белінська. – Режим доступу: http://www.niss.gov.ua/articles/256